The Eighty Billion Dollar Illusion

There is a distinct difference between economic reality and economic reporting. Reality is measured in cash—liquidity moving from a consumer’s bank account to a business’s ledger. Reporting, however, is often measured in smoothed curves, adjusted metrics, and algorithms designed to make chaos look predictable.

We are currently witnessing a massive divergence between these two worlds. If you read the headlines regarding December 2025 retail sales, you likely saw words like “flat,” “disappointing,” or the perennial favorite of bearish pundits: “the tapped-out consumer.” The narrative being sold is one of exhaustion. The claim is that the American engine of consumption has finally stalled.

But if you look at the raw cash—the actual unadjusted dollars that changed hands—the story is not just different; it is the exact opposite.

We just witnessed a record-breaking spike in raw retail spend. The mechanism distorting this reality is a statistical tool known as “seasonal adjustment,” and it has become so aggressive that it is no longer just smoothing the data; it is effectively erasing a small nation’s GDP from the monthly ledger.

The $82 Billion Write-Down

Let’s look at the hard numbers, stripped of their algorithmic paint. In December, unadjusted retail sales did not just rise; they exploded. Sales spiked by $80 billion from November to hit $817 billion. This is the highest raw dollar figure ever recorded for a single month. It is the first time the metric has breached the $800 billion barrier.

Yet, the official seasonally adjusted number reported to the markets was $735 billion.

The gap between what consumers spent ($817 billion) and what the government reported ($735 billion) is $82 billion. To put that in perspective, the statistical adjustment alone—the money the algorithm decided to ignore to “smooth” the chart—is larger than the entire annual revenue of many Fortune 500 companies.

This $82 billion “whack-down” is the largest in history.

Why does this happen? The logic, ostensibly, is sound. Seasonal adjustments are designed to remove the predictable spikes of holiday shopping so that economists can spot underlying trends. We know people buy gifts in December. We know they buy less in January. If we didn’t adjust for this, the chart would look like a saw blade, making it difficult to determine if a drop in January was a market collapse or just a return to normalcy.

However, when the adjustment factor becomes this large, it introduces a dangerous margin of error. The Census Bureau uses the X-13 ARIMA-SEATS software to calculate these factors based on historical data points. But history is becoming a less reliable narrator for the present.

When you apply a massive suppressor to a massive number, even a fractional error in the algorithm results in a multi-billion dollar distortion. In this case, the algorithm determined that the holiday surge “should” have been larger, and because the actual surge was “only” $80 billion, the adjusted result appears flat.

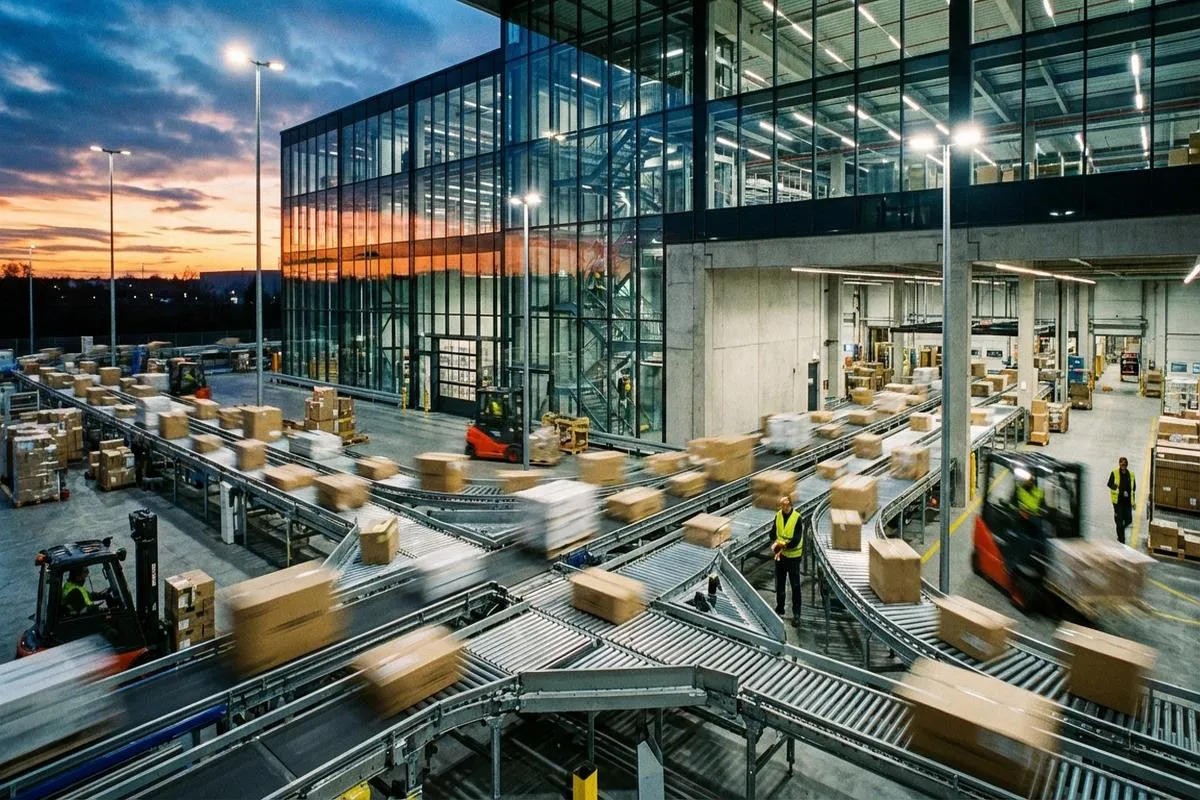

This leads to a strategic blindness. Businesses looking at the adjusted “flat” line might tighten inventory or cut labor, thinking demand is softening. Meanwhile, the actual liquidity flowing through the system is at an all-time high. You cannot pay bills with seasonally adjusted dollars; you pay them with raw cash. And the raw cash says the consumer is still firing.

The Ecommerce Anomaly

The primary driver of this statistical failure is the shift in how we buy. The legacy algorithms rely heavily on the concept of “trading days”—the number of business days in a month, excluding weekends and holidays. This metric was vital when commerce happened in physical stores that closed at 6 PM on Saturday and stayed closed on Sunday.

That world is dead.

Nonstore retailers—primarily ecommerce—accounted for over 20% of total retail sales in December for the first time in history. This category spiked $24 billion month-over-month to reach $166 billion. This is a massive, record-breaking injection of capital into the digital retail space.

Ecommerce operates 24/7. It does not care about “trading days.” It does not care if it is Sunday, a holiday, or 3:00 AM. When an algorithm penalizes a month’s performance because the calendar had fewer “business days,” it is applying analog logic to a digital economy.

The result is a statistical hallucination. The seasonal adjustment whacked $35.7 billion off the ecommerce category alone. That is a 12.6% larger deduction than the previous year. The algorithm is effectively saying, “We expected you to sell even more than this record-breaking amount, so we are going to report this as barely moving.”

Seasonally adjusted, ecommerce sales barely ticked up +0.05%. In reality, they jumped 6.7% year-over-year. For a logistics company or a digital payment processor, the 6.7% jump is the only number that matters. That is the volume strain on the network. That is the transaction fee revenue. The +0.05% is a fiction created for economists who value smooth lines over volatile truth.

The Auto Sector: Subsidies vs. Organic Demand

While ecommerce exposes the structural flaws in the adjustment models, the auto sector highlights a different issue: the distortion of government incentives.

Auto and parts dealers make up nearly 16% of retail sales. In December, raw sales jumped 10.3% to $127 billion. On the surface, this looks like a recovery. However, this volatility is not purely seasonal; it is regulatory.

We saw weakness in October and November. Why? Because federal EV incentives expired at the end of September. This created a classic “pull-forward” effect where buyers rushed to close deals in Q3, draining demand from early Q4.

By December, the market began to normalize, resulting in the 10.3% raw spike. But the seasonal adjustment model struggled to interpret this. It saw a jump and smoothed it down to a -0.2% dip.

The auto industry is currently defined by this “cliff” dynamic. When you look at the 2025 full-year data, unit sales rose 2.4%, but the internal composition is chaotic. Manufacturers like Stellantis and Nissan are flirting with inventory catastrophes, while Toyota and Hyundai-Kia set records.

This creates a high-risk environment for lenders and suppliers. A smooth “seasonally adjusted” line hides the fact that specific OEMs are stuffing channels while others are selling out. The aggregate data is masking a solvency crisis in specific corners of the market. If you are financing dealer floor plans, you shouldn’t care about the adjusted aggregate; you need to worry about the raw velocity of the specific brands you are exposed to.

Inflation or Volume?

One valid critique of the raw sales record is the inflation factor. Are consumers actually buying more stuff, or are they just paying more for the same amount of stuff?

Year-over-year, unadjusted retail sales increased by 3.8%. This matches the annual 2025 increase of 3.7%. If inflation is running near those levels, then real volume growth is essentially flat.

However, from a cash flow perspective, this distinction is secondary to the immediate liquidity question. A business with flat volume but 4% higher revenue is still generating record cash flow (assuming margins hold). The data shows that despite price pressures, consumers are validating the higher price points. They are not balking. They are paying.

Look at the “Food Services and Drinking Places” category—restaurants and bars. This is discretionary spending. You have to eat, but you don’t have to eat at a restaurant.

Unadjusted sales here rose 3.5% month-over-month and 4.5% year-over-year to $100 billion. The consumer is complaining about prices, yet they continue to validate those prices at the point of sale. If the consumer was truly “tapped out,” this is the first category that would roll over. It hasn’t. It is hitting $100 billion a month.

The Grocery Floor

Food and Beverage stores (grocery) tell a similar story of resilience. Sales spiked 6.1% in December to $91 billion. While seasonally adjusted data shows a meager 0.2% rise, the raw cash register is ringing.

This sector is the baseline for inflation monitoring. A 1.8% year-over-year increase here is actually quite low, suggesting that food inflation may have moderated compared to other sectors, or that consumers are aggressively trading down to private labels to manage the overall basket cost.

The Logic of the “Whack-Down”

The massive disparity between the $82 billion adjustment and reality forces us to ask: Is the tool broken?

The X-13 ARIMA-SEATS software is trying to force a post-COVID, high-inflation, 24/7 digital economy into a pre-2019 statistical box.

In a stable environment, these adjustments sum to zero over a 12-month period. They borrow from December to pay January. But we are not in a stable environment. We are in an environment of shifting consumption habits (services vs. goods), shifting purchase channels (brick-and-mortar vs. mobile), and shifting monetary value (inflation).

When the inputs become this volatile, the smoothing mechanism becomes a distortion mechanism. It signals weakness where there is strength.

Strategic Implications

For the business operator or the investor, the lesson here is to stop managing to the headline.

- Ignore the “Disappointment”: If you see headlines about a “disappointing holiday season” based on flat adjusted numbers, recognize this as a statistical artifact. The $817 billion raw figure proves the demand is there.

- Follow the Cash, Not the Rate: The Federal Reserve and other policy bodies look at adjusted data to gauge overheating. If the adjusted data shows a cooling economy, they may pause tightening or consider cuts. But if the raw data shows the economy is still running hot, inflation will remain sticky. This mismatch creates a policy risk where the Fed might misread the temperature of the room.

- Ecommerce is Undervalued: The adjustment penalized ecommerce the hardest. This suggests the underlying momentum in digital retail is stronger than the official prints suggest. If you are allocating capital, the digital infrastructure is handling more volume than the “flat” charts imply.

The economy is not a smooth line. It is a messy, volatile series of transactions. Right now, those transactions are hitting record highs. Do not let a legacy algorithm convince you that $817 billion is a sign of weakness.